Case Study: Insurance for clients with medical conditions

Amanda* is 48 and works in an office job. When she came to us, she was in the middle of breast cancer treatment and assumed insurance wasn’t an option.

“I know I can’t get insurance because of my cancer,” she told us. “But I’m hoping you can help with my super and cash flow.”

She was right – applying for insurance through a retail insurance provider after being diagnosed with cancer and while undergoing treatment, would almost certainly be declined. Even years after full recovery, retail insurers often apply heavy exclusions or higher premiums.

But we found a way! For this client, Steps found a solution by being creative and thinking outside the box…

Some Industry Super funds offer automatic insurance cover to new members – no medical checks required. These offers vary between funds, so it’s important to understand the fine print. Some allow you to increase your cover by answering a few basic questions, and others let you transfer existing cover from another fund. While pre-existing conditions are usually excluded for a period, full cover can kick in after a certain waiting period has been met.

For Amanda, this meant she could access valuable insurance benefits – all while she could focus on her cancer treatment and getting better.

Our proposal included:

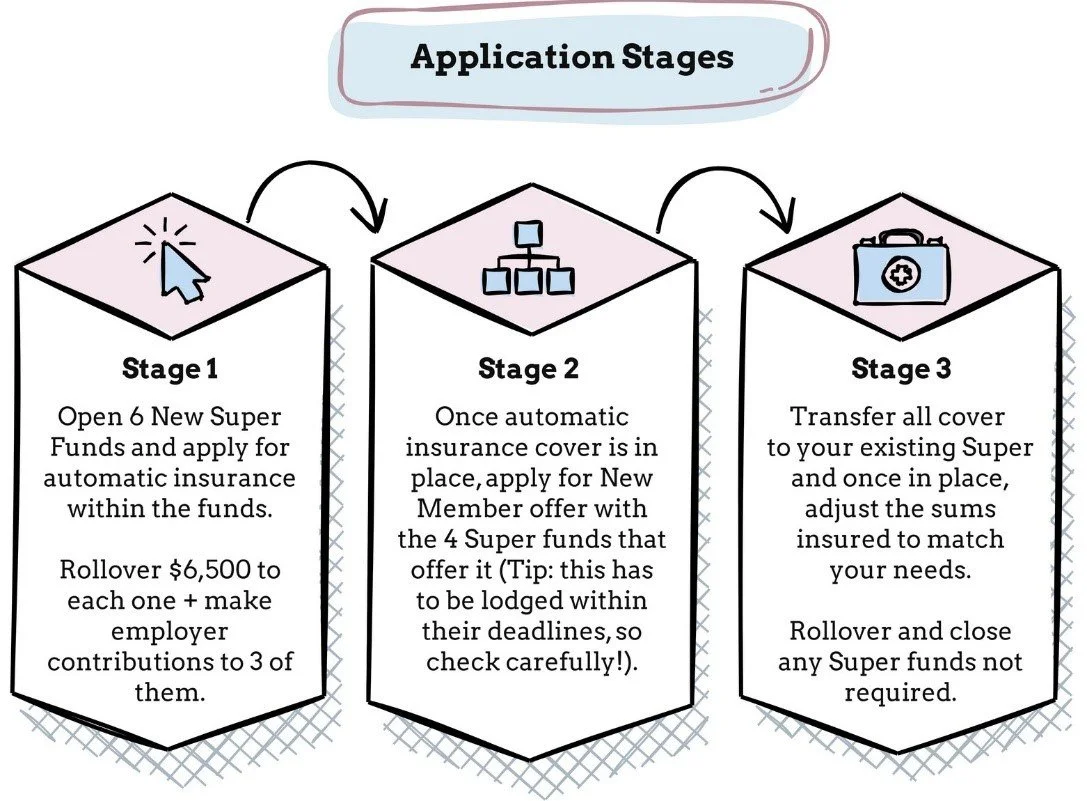

Opening several new Industry Super funds to take advantage of their automatic insurance cover as well as any new member special offers.

Once the new cover was in place, she transferred the insurance back to her existing super account and closed the temporary funds.

As a result, Amanda was able to secure:

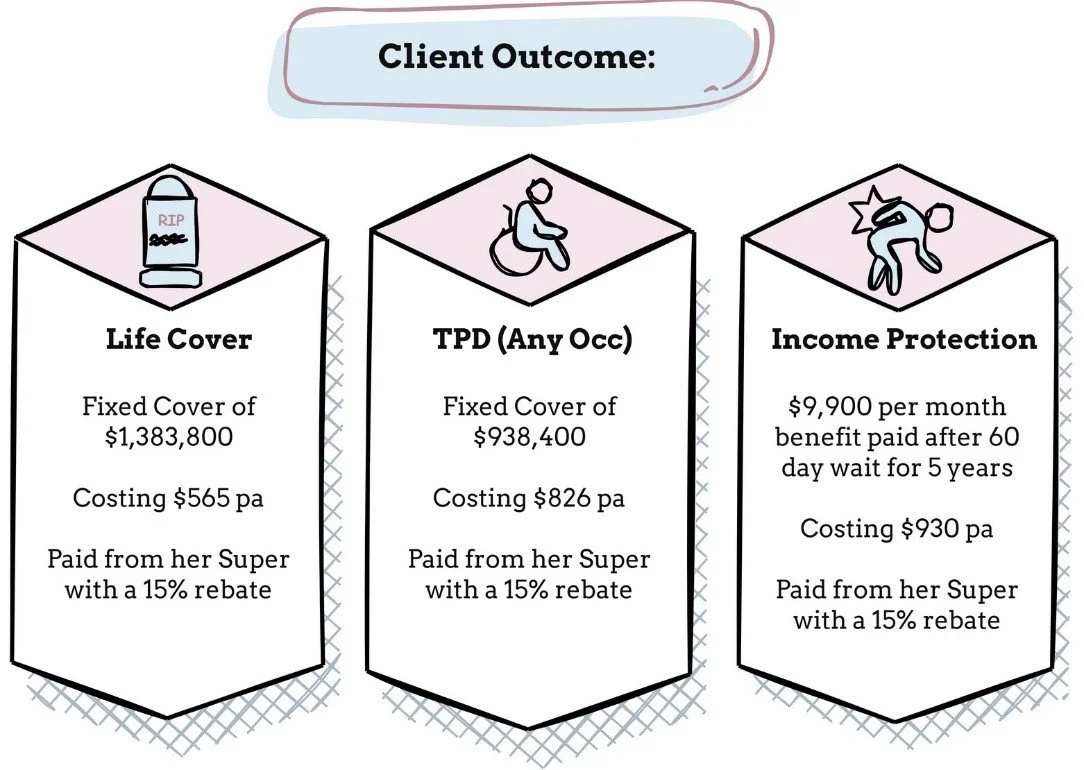

Life insurance to provide her family with financial protection in the event she passes away or becomes terminally ill.

Total & Permanent Disability (TPD) cover to provide a lump payment in the event an injury or illness resulted in her not being able to ever work again.

Valuable Income Protection cover which could provide her with a monthly income in the event she was unable to work for due injury or illness.

It’s a great example of how smart advice and knowing the system can make a real difference!

Steps Financial always ensure our clients understand the importance of being honest when completing insurance forms. Non-compliance can result in the claim being denied, even if it has nothing to do with the condition that you didn’t disclose. Knowing the providers and their requirements is crucial in finding the best solution for our clients. That’s why our research is thorough, and our advice is delivered in clear, easy-to-understand steps — no jargon. Just practical guidance and a solution that is as individual as our clients are.

If you or someone you know is facing a health challenge and is unsure about insurance options, we’re here to help. You don’t have to navigate it alone. Let us find the path that works for you!

*Not her real name.

Steps Financial is a Corporate Authorised Representative (No. 436805) of Spark Advisors Australia Pty Ltd ABN 34 122 486 935 AFSL 380552.

The information on this social media page and the links has been prepared for general information purposes only and does not take into account your personal objectives, financial situation or needs. It is not intended to provide commercial, financial, investment, accounting, tax or legal advice. You should, before you make any decision regarding any information, strategies, or products mentioned on this page, consult a professional financial advisor to consider whether it is suitable and appropriate for you and your personal needs and circumstances. Before making a decision to acquire a financial product, you should obtain and read the Product Disclosure Statement (PDS) relating to that product, together with the Target Market Determination (TMD).